If you’ve been wondering how to connect mobile money to a website in Uganda, you’re not alone. As online shopping, bookings, and digital services grow, customers now expect smooth and secure Mobile Money payments directly on your website. At B&E Designs, we help businesses integrate MTN Mobile Money, Airtel Money, and Visa/Mastercard using verified third-party providers.

Why Mobile Money Integration Matters for Ugandan Businesses

Imagine a customer browsing your beautiful B&E Designs products, ready to make a purchase, only to find that their preferred payment method isn’t available. This is a common scenario in regions where mobile money dominates the payment landscape.

Therefore, by integrating mobile money, you unlock several key advantages:

Expand Your Customer Reach: Tap into a vast customer base who primarily use mobile payments for transactions.

Increase Conversion Rates: Remove payment barriers and make it easier for customers to complete purchases.

Enhance Customer Trust: Offer a familiar and secure mobile money payment option, building confidence in your brand.

Streamline Operations: Automate payment processing and reconciliation, which saves you time.

The Essential First Step: Business Registration

Before you can integrate any payment gateway, including mobile money, it’s absolutely crucial that your business is legally registered. This isn’t just a recommendation; it’s a requirement from payment providers and a legal obligation.

Why is this important?

Legitimacy: Registered businesses are seen as legitimate and trustworthy by payment providers and customers alike.

Compliance: Payment gateways need to comply with financial regulations and “Know Your Customer” (KYC) policies, which require verified business information. Consequently, registration is mandatory.

Security: Registration helps prevent fraud and ensures secure transactions for both your business and your customers.

If you haven’t already, make sure your business is properly registered with the relevant authorities in Uganda. This includes obtaining necessary licenses and tax registrations. For more details on this process, we recommend visiting the official government business registration portal .

Leveraging Third-Party Providers: The Power of Pesapal and Others

Instead of connecting directly to MTN or Airtel, most websites—including those designed at B&E Designs—use trusted third-party payment providers. These companies already have approval and API connections with telecoms, making integration simple and secure.

What do these providers do?

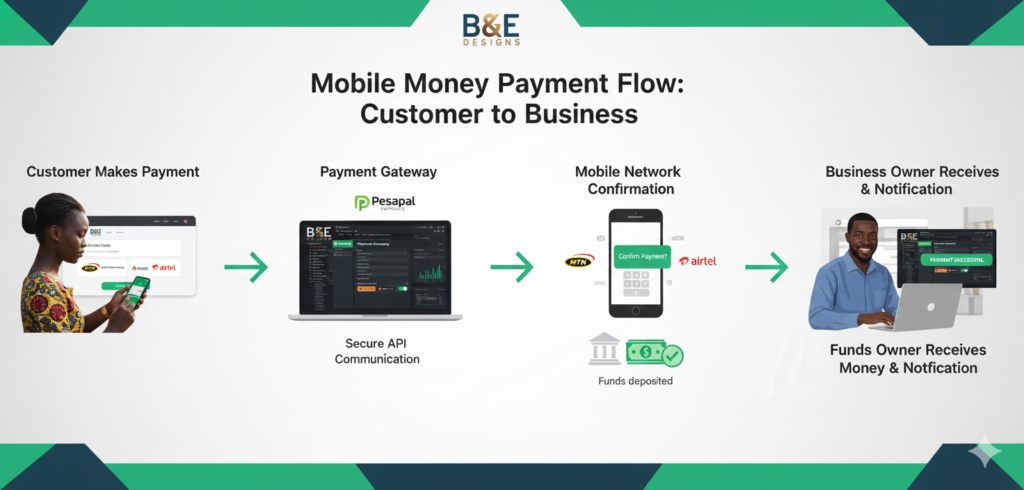

Third-party payment gateways act as an intermediary between your website, your bank, and various online payment methods, including mobile money. They handle the complex technical aspects of processing payments, ensuring security, and often provide a unified platform for managing all your transactions.

How the Process Works with B&E Designs:

1. Business Registration & Account Setup:

Ensure your business is fully registered (as discussed above).

We’ll guide you through setting up an account with a chosen payment provider like Pesapal. This typically involves submitting your business registration documents, bank details, and other necessary information for verification.

Self-check: Have all your business documents ready and organized for a smooth application process.

2. API Intergration

- Once your payment provider account is approved, they will provide you with API (Application Programming Interface) keys and documentation.

- Our skilled developers at B&E Designs will then use these APIs to integrate the mobile money payment functionality directly into your website’s checkout process. This allows your website to communicate securely with the payment provider’s system.

3. Customization and User Experience:

- We’ll work with you to customize the payment experience to match your brand and ensure a smooth, intuitive flow for your customers. This includes designing the checkout page, displaying clear payment instructions, and handling transaction feedback.

- For mobile money, this usually involves the customer entering their mobile money number, receiving a prompt on their phone to approve the payment, and then confirming it with their PIN.

4. Thorough Testing

Before going live, we conduct rigorous testing of the entire payment process. This ensures that payments are processed correctly, funds are received, and customers have a flawless experience. To see examples of our successful integrations, please visit our B&E Designs Case Studies page

5. Going Live and Support

Once everything is tested and approved, your Connect Mobile Money to Website feature will be live!

B&E Designs provides ongoing support to ensure your e-commerce solutions remain functional and secure. You can learn more about Pesapal’s services and support directly on their website.

Ready to Empower Your Business with Mobile Money?

Connecting mobile money to your website opens up a world of opportunities for your business. It demonstrates your commitment to customer convenience and positions you for growth in the digital economy.

At B&E Designs, we are experts in creating stunning, functional, and payment-ready websites. Let us take the complexity out of integrating mobile money, so you can focus on what you do best – running your business. Explore our services today